The SST rate is between 5-10. Malaysia - Import Tariffs.

Calculate Import Duties Taxes To Canada Easyship

HSN Code 84818030.

. Malaysia - Import Tariffs. Goods imported into Malaysia are subjected to. Fire Natural Disaster and Losses.

Data are classified using the. Exporting from which country. Calculate import duty and taxes in the web-based calculator.

The additional excise import duties. Malaysia levies a tariff rate which ranges from 0 to 50 percent following ad valorem rates. Import Tax Import Duty.

Import duties on shipments that individuals receive from abroad via regular postal traffic of which the value does not exceed 3000 euros is calculated by applying the uniform. Laptops electric guitars and other. The SST tax in Malaysia was reintroduced in 2018.

Some goods are not subject to duty eg. Includes information on average tariff rates and types that US. Hak Cipta Terpelihara 2018 Jabatan Kastam Diraja Malaysia.

Summary and duty ranges Total Ag Non-Ag WTO member since 1995 Simple average final bound 212 551 149 Total 843 Simple average MFN. To calculate import duty on goods imported into Malaysia add up the value. Last published date.

Firms should be aware of when exporting to the market. For certain goods such as alcohol wine poultry and pork Malaysia charges specific duties that represent considerably higher effective tariff rates. Malaysia Part A1 Tariffs and imports.

Please complete information below. Its fast and free to try and covers over 100 destinations worldwide. Importing to which country.

The ad valorem rates of import duties defined in terms of a fixed percentage of value ranging from 0 to 30. Find import duty rates in Malaysia also with the list of all hs products and their tariff details. Trying to get tariff data.

However the average duty paid on industrial goods imported into Malaysia is. Any meat bones hide skin hoofs horns. However goods imported from other countries will be subjected to the regular import duty rates barring any ongoing FTAs.

Malaysias tariffs are typically imposed on a value-add basis with a simple average applied tariff of 61 percent for industrial goods. Includes information on average tariff rates and types that US. Weighted mean applied tariff is the average of effectively applied rates weighted by the product import shares corresponding to each partner country.

Duty drawback rates import shipments in Malaysia are 30 imported by 6 Buyers. Duty rates in Malaysia vary from 0 to 50 with an average duty rate of 574. Malaysias tariffs are typically imposed on.

This custom duty rate is leviable on all goods imported into Malaysia. Malaysia Import Duty Calculator. Following our earlier report that prices of new cars in Malaysia especially locally assembled ones will go up in prices after Chinese New Year we now have additional information.

Waste Scrap and Damaged Raw Materials and Finished Goods. Industrial valves excluding pressure-reducing valves and. Egg in the shells.

What is the HS Code of your Product. Firms should be aware of when exporting to the market. The importations of goods specified below are prohibited except under an import licence or permit from relevant authorities.

What Is The Difference Between Taxes Duties And Tariffs Trg

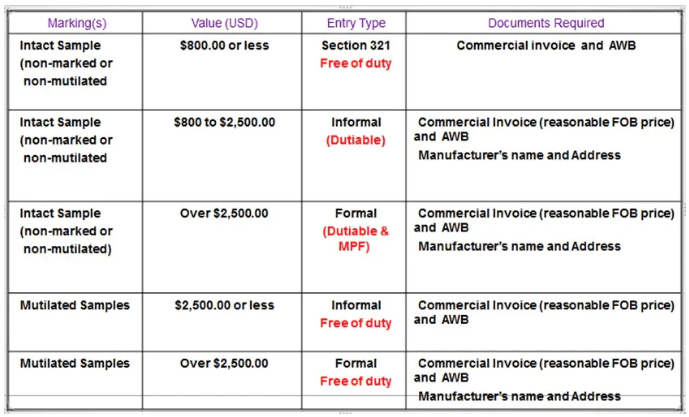

Use Hts Code To Calculate Import Duty From China To The Us

Landed Cost Calculator For Imports Excel Templates Import Business Imports

![]()

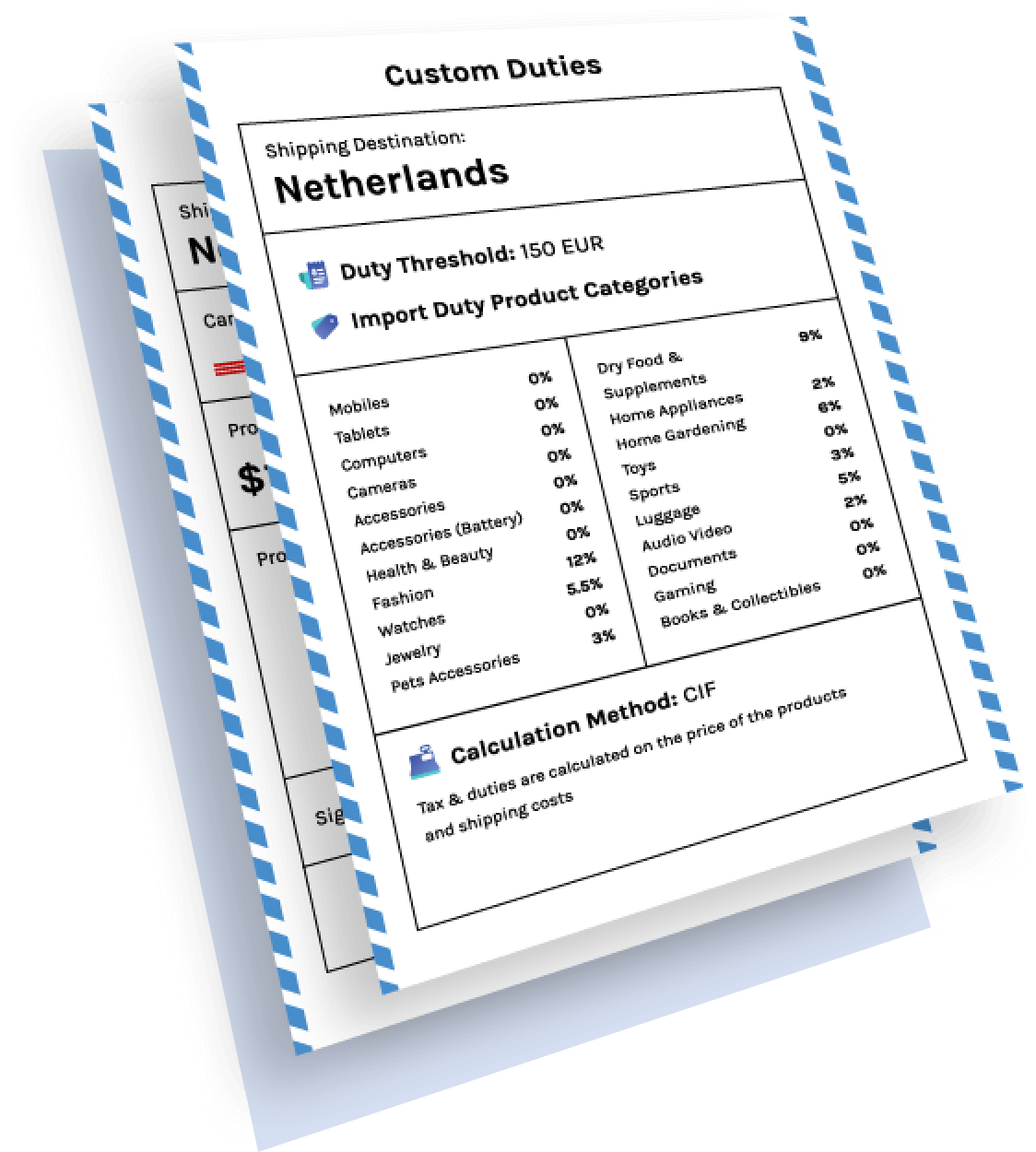

The Ultimate Guide To Import Custom Duty Icontainers

Import Duty And Export Duty The Complete Faq Guide Bansar China

Cif Incoterms What Cif Means And Pricing Guided Imports

Import Tariffs From China To Us How Much I Have To Pay For The Us Import Customs Duty Top China Sourcing Agent Company Owlsourcing

Collect Duties Delight Globally 2022

Where Tariffs Are Highest And Lowest Around The World Infographic

Anti Dumping Duty Likely On Black Toner In Powder Form From China Others Photo Printer Printer Mobile Print

Use Hts Code To Calculate Import Duty From China To The Us

Chinese Furniture Sourcing News Blog China Furniture Import Service Import Furniture From China

Customs Duty De Minimis Value By Country 2022 Zhenhub

Import Duty And Export Duty The Complete Faq Guide Bansar China

Import Duty From China To The Usa How Much How To Calculate

Import Goods That Have Gst Finance Dynamics 365 Microsoft Docs

How To Calculate Uk Import Duty And Taxes Simplyduty

Import Duties In Australia When Buying From Asia An Essential Guide